The Vehicle (What Futures Actually Are)

By the end of this module, you will clearly understand what a futures contract is, why it exists, and why it is the preferred instrument for professional traders and prop firms.

🔹 1. The Time Travel Concept

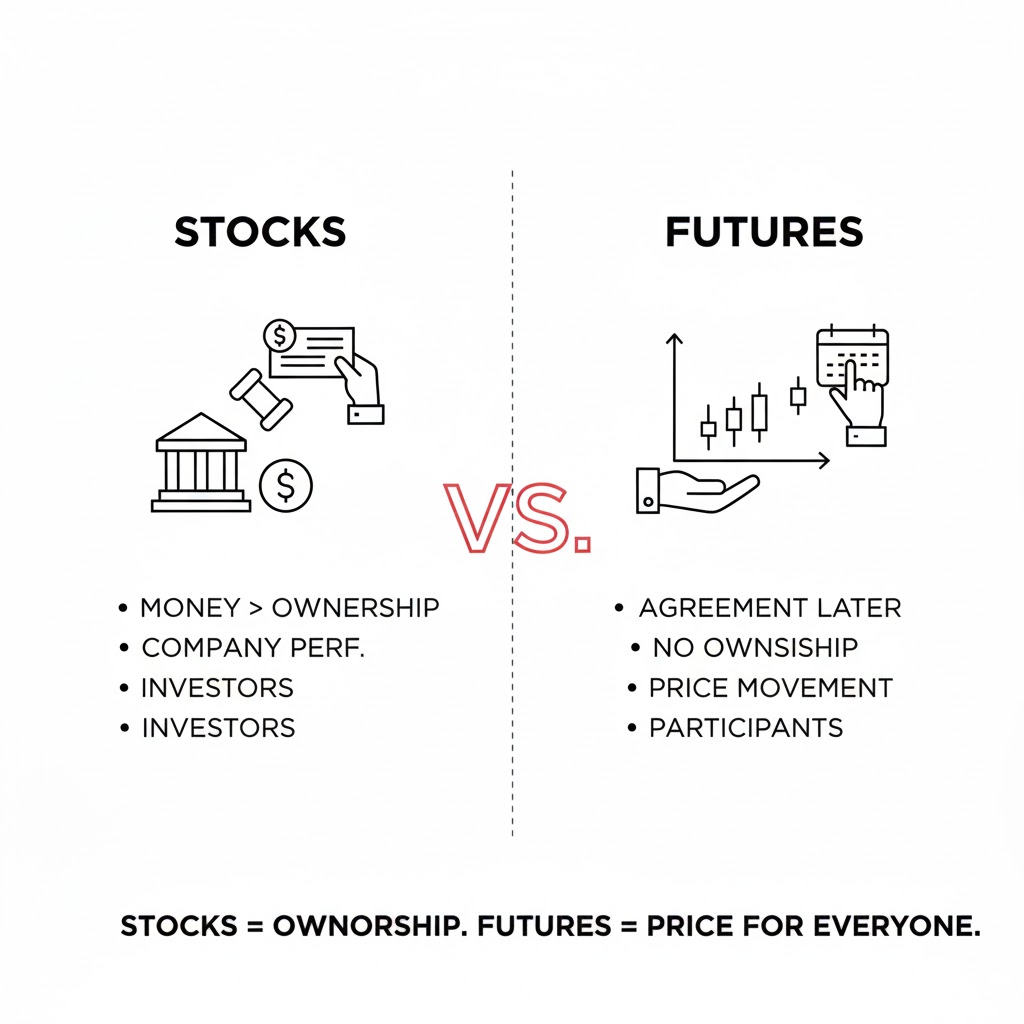

Most people understand stocks. You exchange money and receive ownership in a company. Your profit or loss is tied to how that company performs over time.

Futures do not work that way.

A futures contract is a standardized agreement to transact at a later date, based on what the market believes something will be worth in the future. You are not buying ownership. You are participating in price movement.

This is why futures feel unfamiliar at first. They are not built for investors. They are built for participants.

🔹 2. Why Futures Were Created

Futures were born from uncertainty.

In the 1700s, Japanese rice farmers faced unpredictable pricing. A strong harvest could collapse prices by the time crops reached the market. To protect themselves, farmers and buyers agreed on prices ahead of time.

Those agreements created stability. Over time, they became standardized contracts traded openly.

🔹 3. Futures in the Modern World

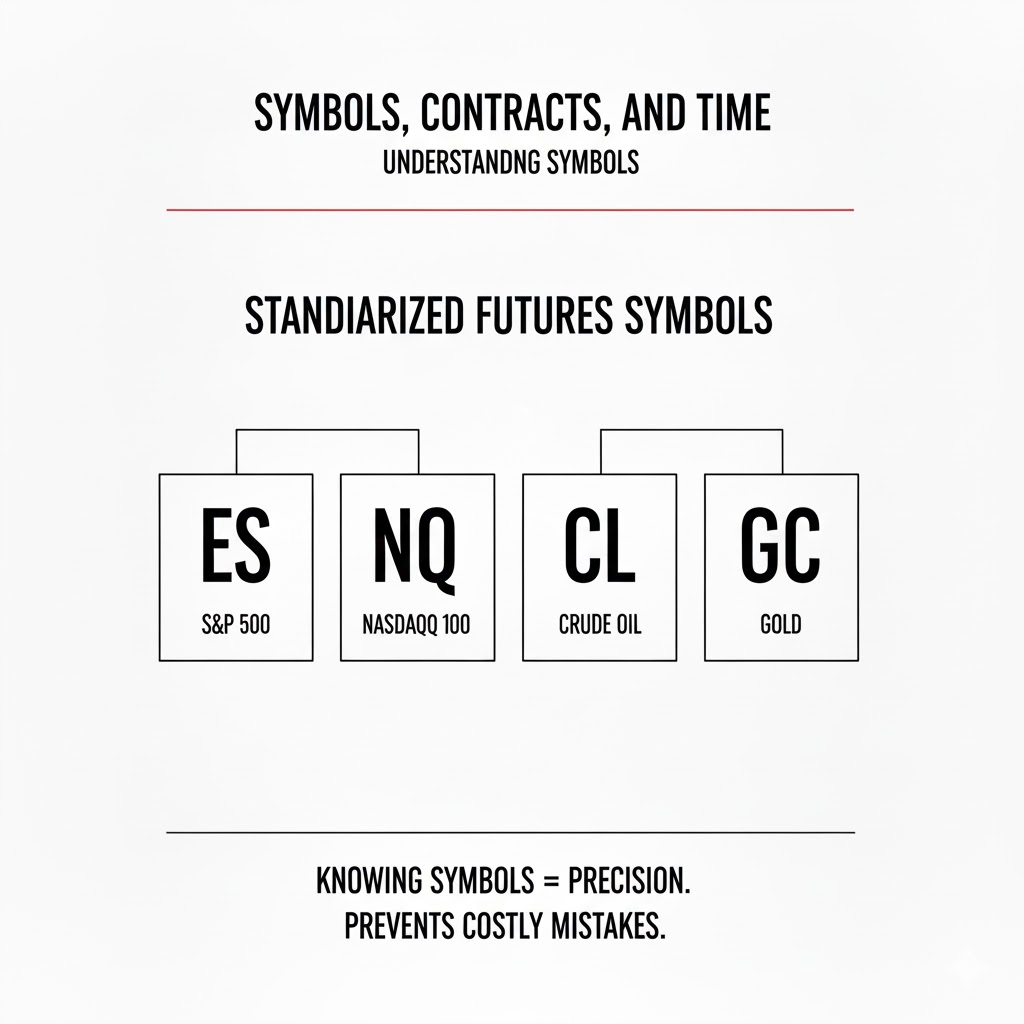

Today, futures trade global markets. Equity indices, commodities, interest rates, and currencies.

When you trade the S and P 500 through the ES contract, you are not buying shares of companies. You are trading expectations. You are participating in how the market values the index at a future point in time.

This distinction matters because it changes how you think.

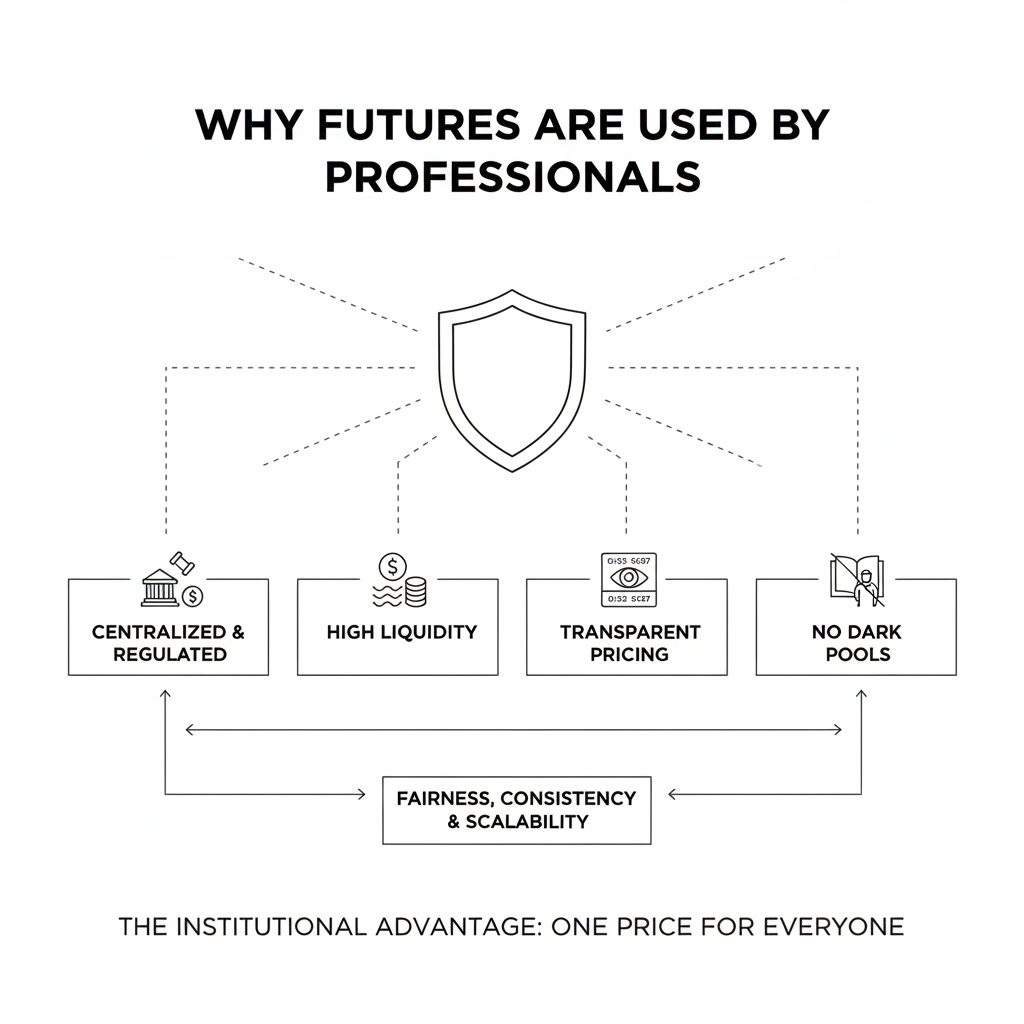

🔹 4. Why Futures Are Used by Professionals

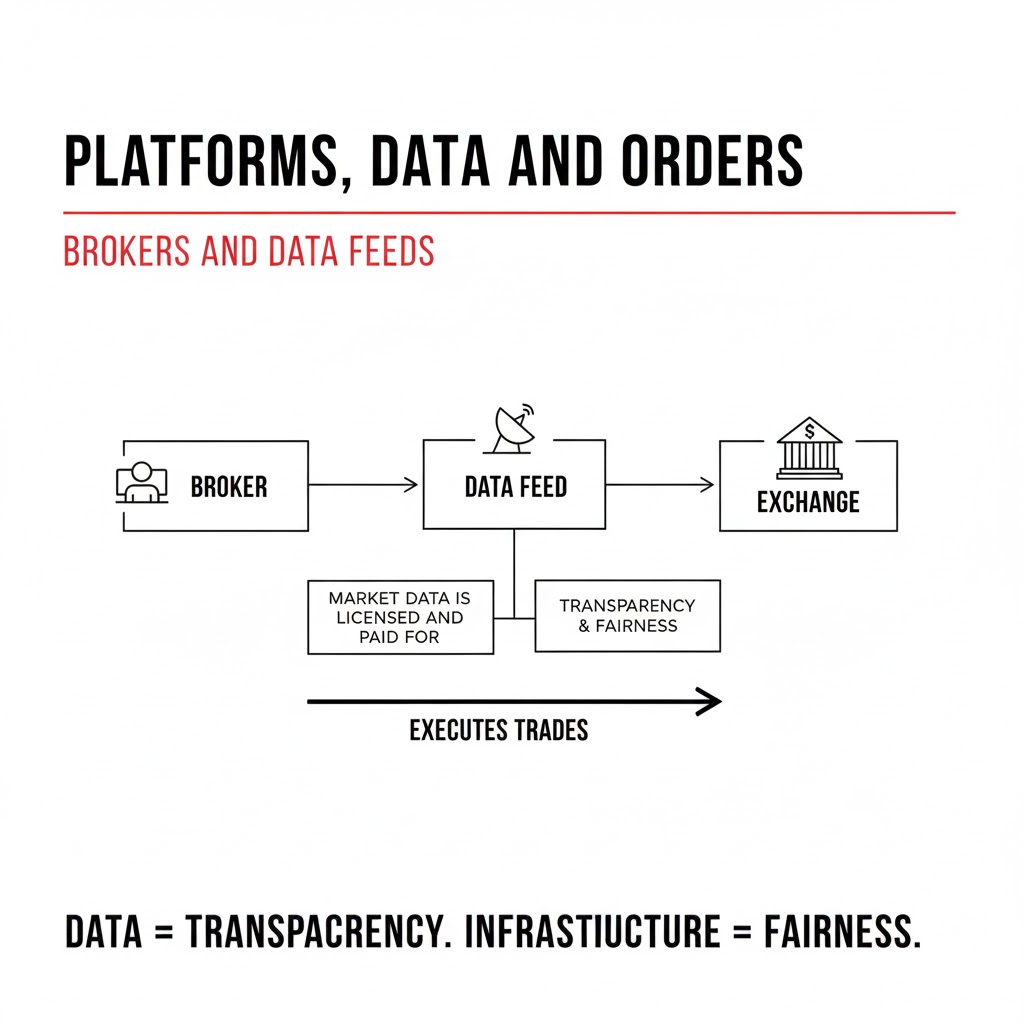

Futures markets are centralized, regulated, liquid, and transparent. Every participant sees the same price. There is no dark pool advantage.

This structure is why institutions and prop firms operate here. It creates fairness, consistency, and scalability.

🎯 Checkpoint: Before You Move On

You should understand what a futures contract represents and why it exists.

✅ Module Knowledge Check

What best describes a futures contract?

📝 Module Summary

- Futures trade future value

- They were created to reduce uncertainty

- They are designed for participation, not ownership

- Professional markets prefer standardized contracts