Welcome to Level 3

Understanding the World of Funded Accounts

In Level 1, you learned what futures are.

In Level 2, you learned how to read the market and manage risk.

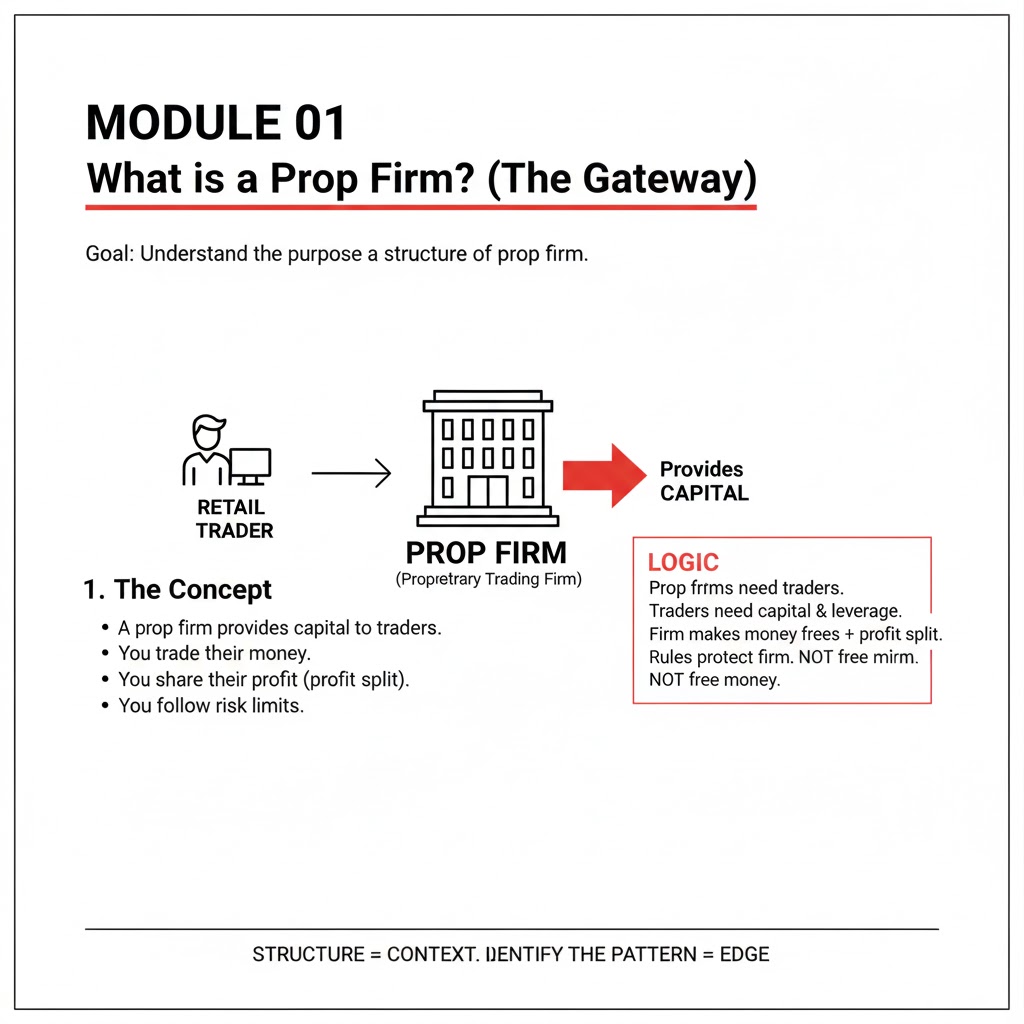

Level 3 is about the structure of prop firms—the companies that offer "funded accounts" so traders can trade with someone else's capital. This course does not teach trading strategies, does not rely on proprietary methods, and focuses purely on how prop firms operate, what their rules are, and how to navigate them safely.

By the end of this course, you will understand:

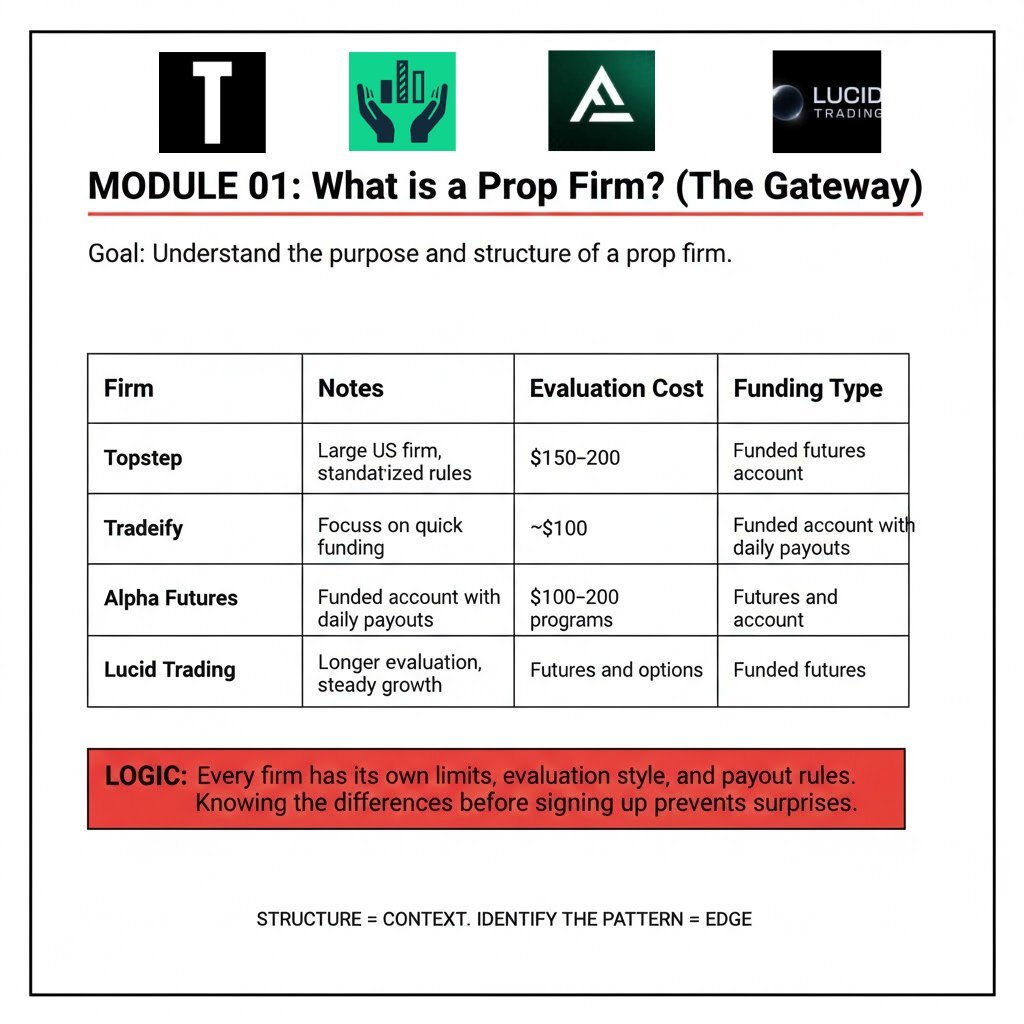

- The types of prop firms and how they differ.

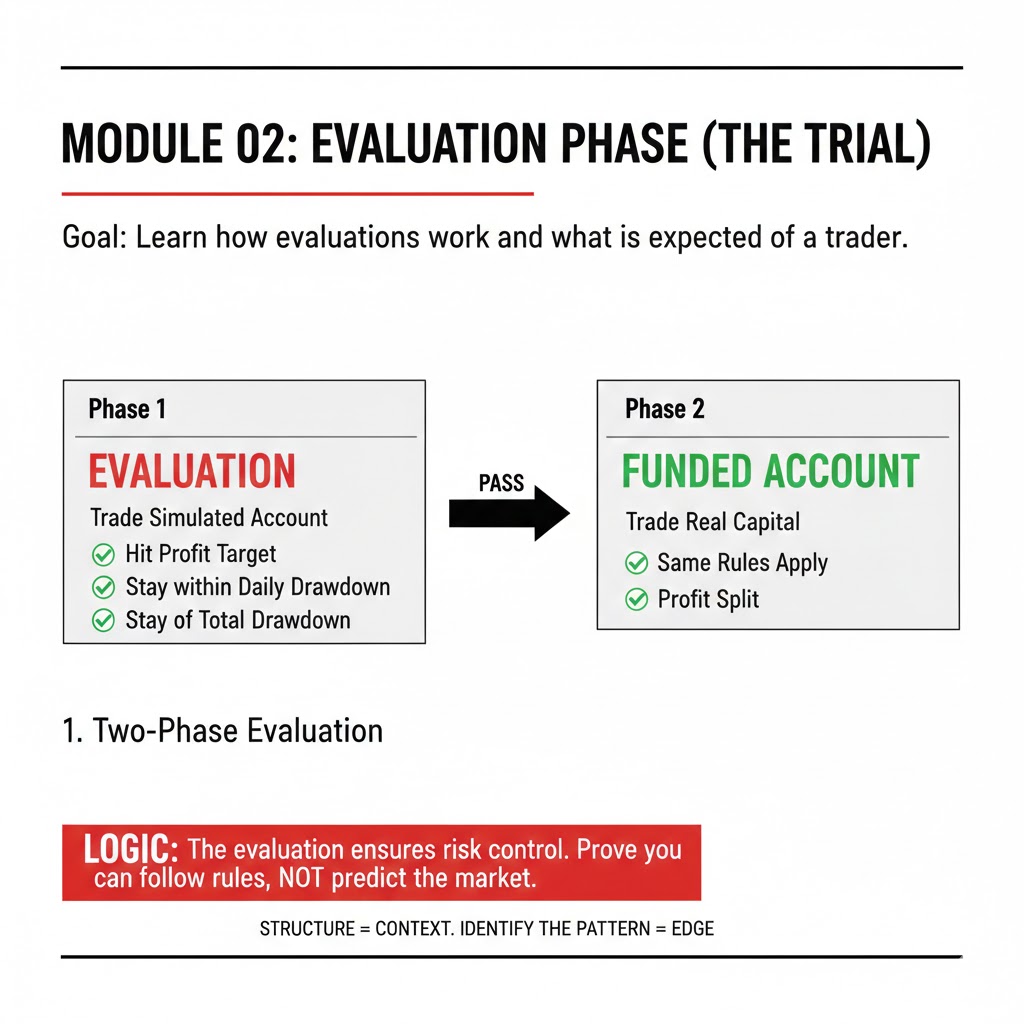

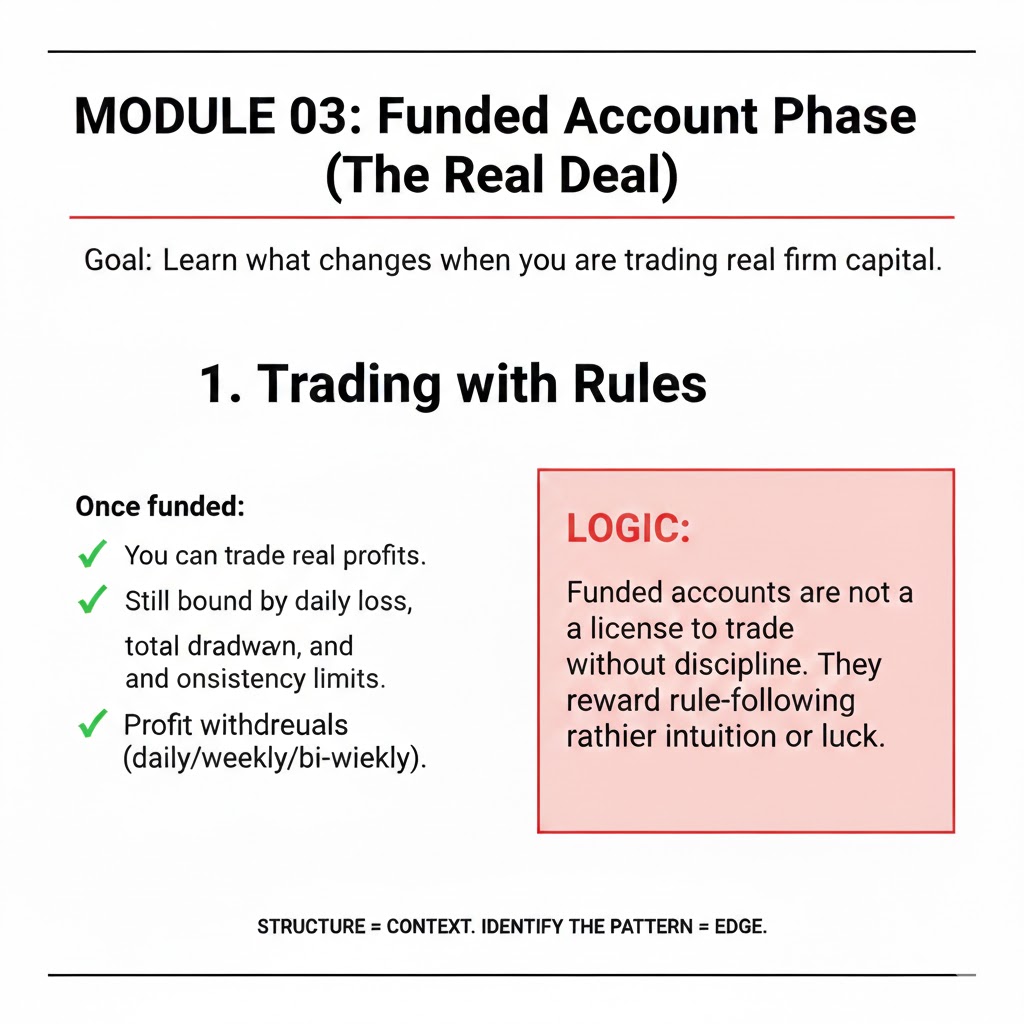

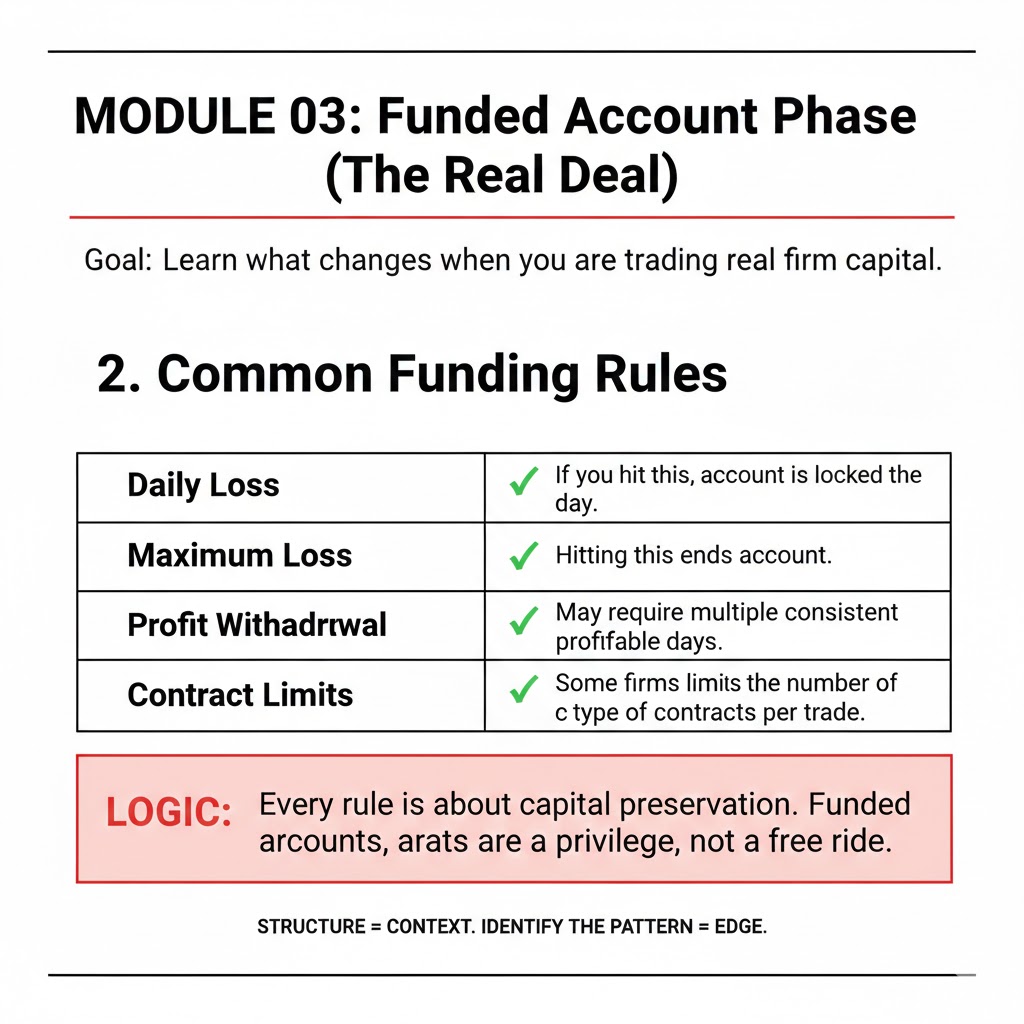

- The evaluation and funded account process.

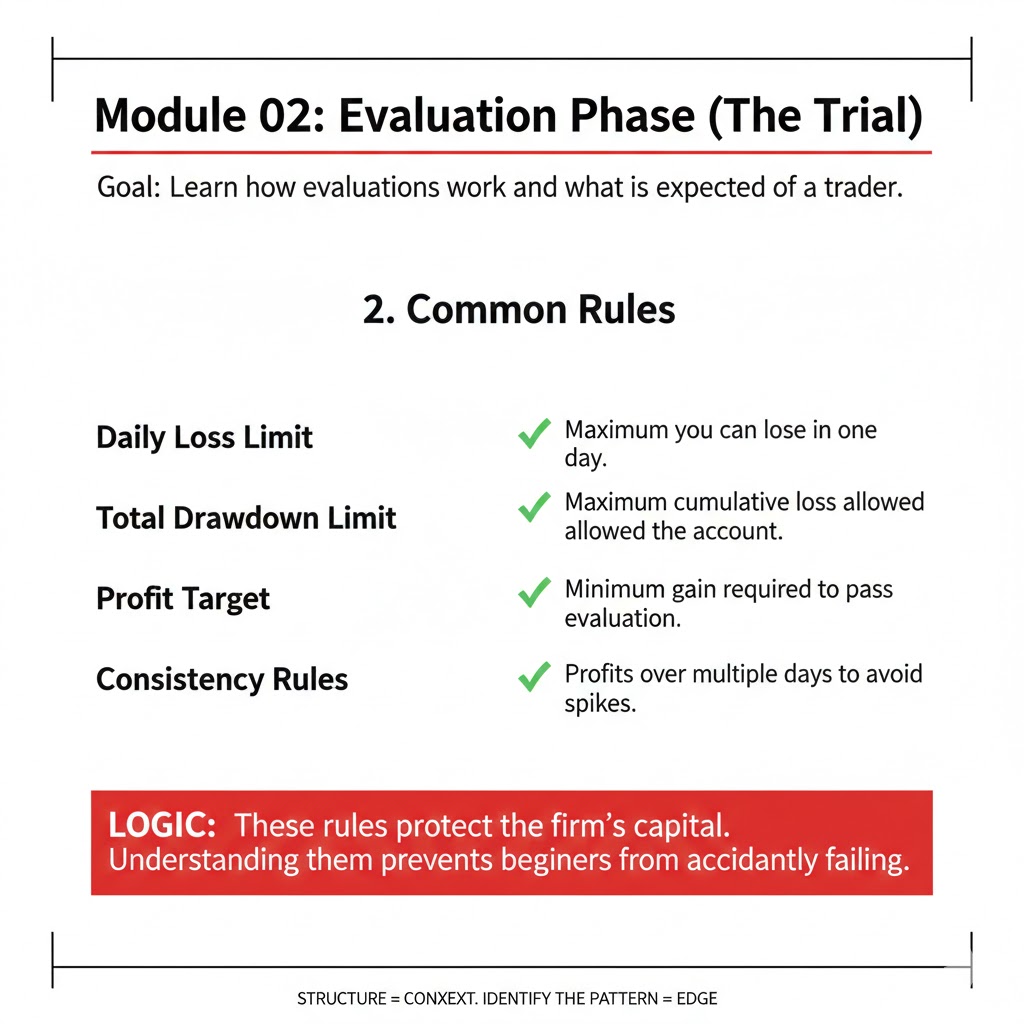

- Key rules, limits, and expectations of funded trading.

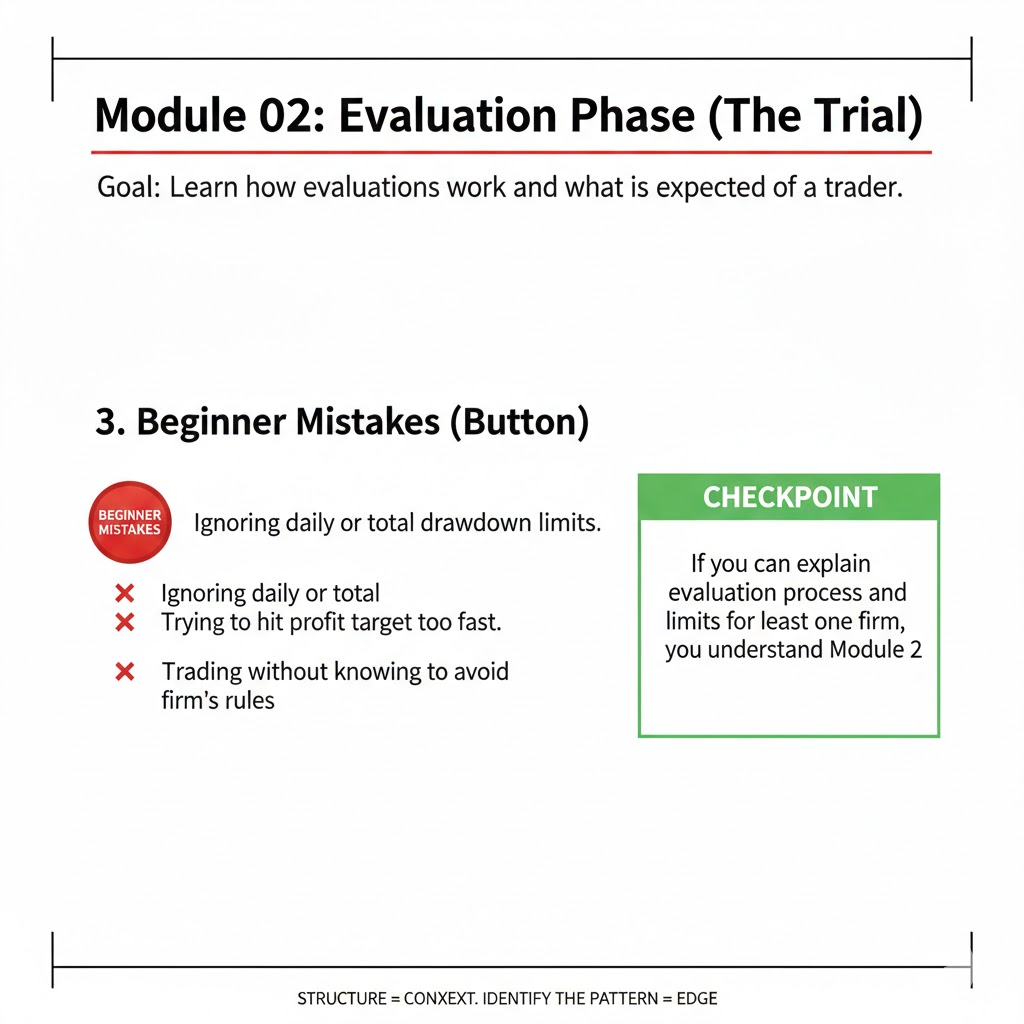

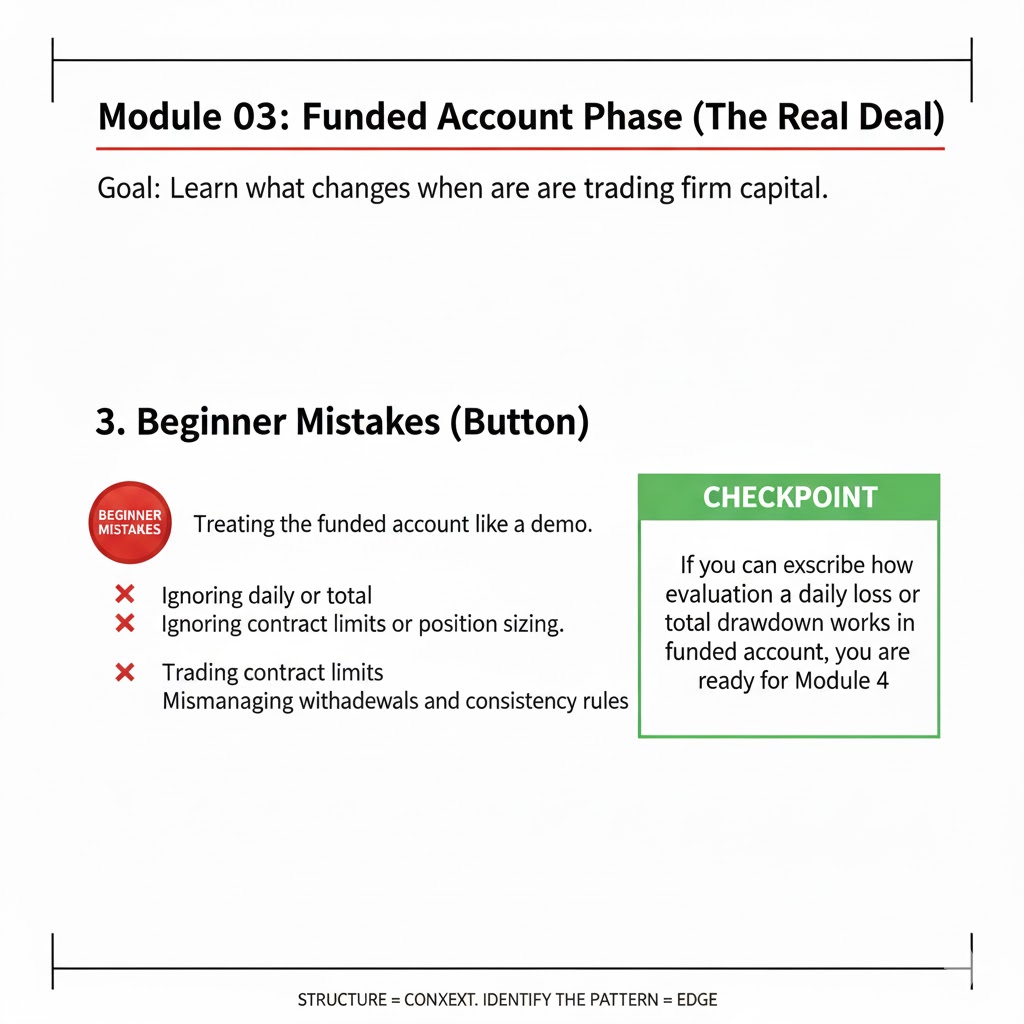

- How to avoid common beginner mistakes in prop firm accounts.

This is your map for the funded trading world, so you start with knowledge, not guesswork.